Navigating the financial world can be a complex endeavor, particularly when it comes to understanding the importance and implications of credit scores. Every financial decision you make, whether it’s buying a car, financing a home, or even selecting an insurance policy could be impacted by your credit score. It serves as an integral part of your financial health, profoundly influencing your accessibility to various credit and loan products. This article will dig into what credit scores are, their range, and how they are calculated using factors such as payment history, amounts owed, and length of credit history. In addition, practical tips for improving and maintaining a commendable credit score will be shared. We will also explore the far-reaching impact of a good credit score on various aspects of personal finance, such as loan approvals, interest rates, and insurance premiums.

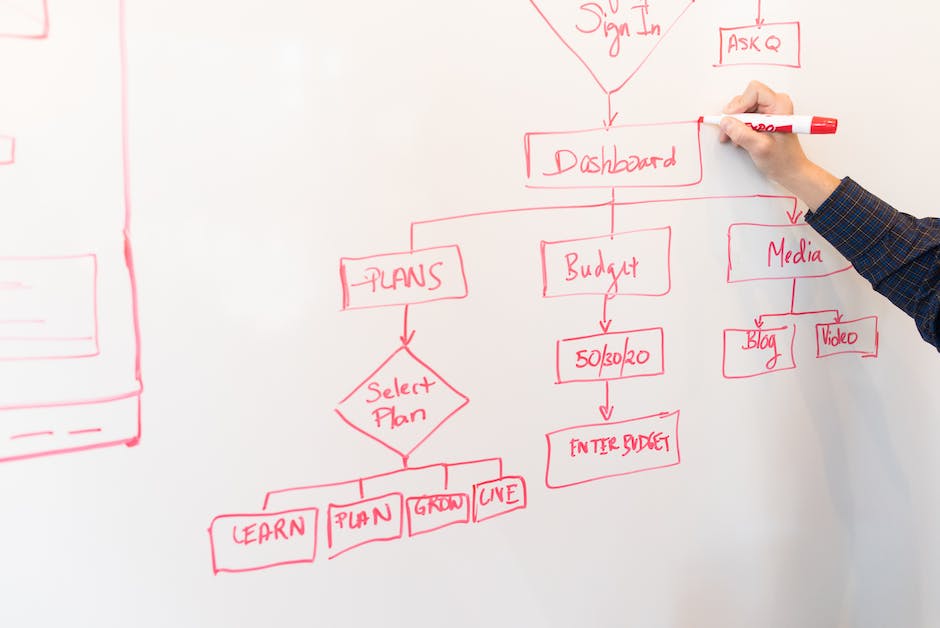

Understanding Credit Scores

A credit score is a three-digit number that signifies a person’s creditworthiness based on their credit history. Banks and lenders use credit scores to evaluate the potential risk posed by lending money to consumers. There are two primary types of credit scores, FICO scores, developed by Fair Isaac Corporation, and VantageScores, developed by the three major credit bureaus: Experian, Equifax, and TransUnion.

FICO Scores

FICO Scores range from 300 to 850. These scores are calculated based on five different categories: payment history (35%), amounts owed (30%), length of credit history (15%), types of credit used (10%), and new credit (10%). FICO Scores are used by 90% of top lenders to make credit and loan decisions.

VantageScore

VantageScore is another type of credit score, also ranging from 300 to 850. VantageScore uses a somewhat similar methodology to FICO, but its percentages for types of credit information are undisclosed. It considers payment history, age and type of credit, percent of credit limit used, total balances/debt, recent credit behavior, and available credit.

What Constitutes a Good Credit Score?

While the definition of a ‘good’ credit score can vary between different lenders, generally, a score of 700 or above is considered ‘good’ under both FICO and VantageScore systems. Scores between 800 and 850 are deemed as ‘excellent.’

Scores in the range of 670 to 739 are considered ‘good’ by FICO standards, whereas VantageScore regards scores between 661 and 780 as ‘good’. It’s important to remember that definitions may vary between lenders.

Why is a Good Credit Score Important?

Having a good credit score can facilitate many financial processes in life. It’s the key to getting approved for loans, credit cards, and mortgages. It also means lower interest rates and better terms on loans and credit cards.

Ultimately, a good credit score streamlines and provides better opportunities for your financial transactions, making it easier for you to reach important life goals such as buying a house or securing finances for your business.

Building and Sustaining a Favorable Credit Score

Building a commendable credit score involves developing a long-standing history of dependable credit usage. This requires you to make timely payments, keep balances low, and only apply for new credit when absolutely essential. Before they can trust you with higher loan amounts or offer more favorable rates, creditors need to see evidence of your responsible debt management.

It’s worth noting that even one late payment or an unusually high balance can lead to a significant dip in your credit score. This necessitates the continuous monitoring of your credit report and making sure to never exceed over 30% of your available credit limit. A lower credit utilization rate is appealing to lenders as it demonstrates that you have not exhausted your credit cards and have a good handle on your credit management.

By comprehending how credit scores work and the elements that influence them, you can implement steps to maintain a favorable credit score, leading to substantial financial advantages.

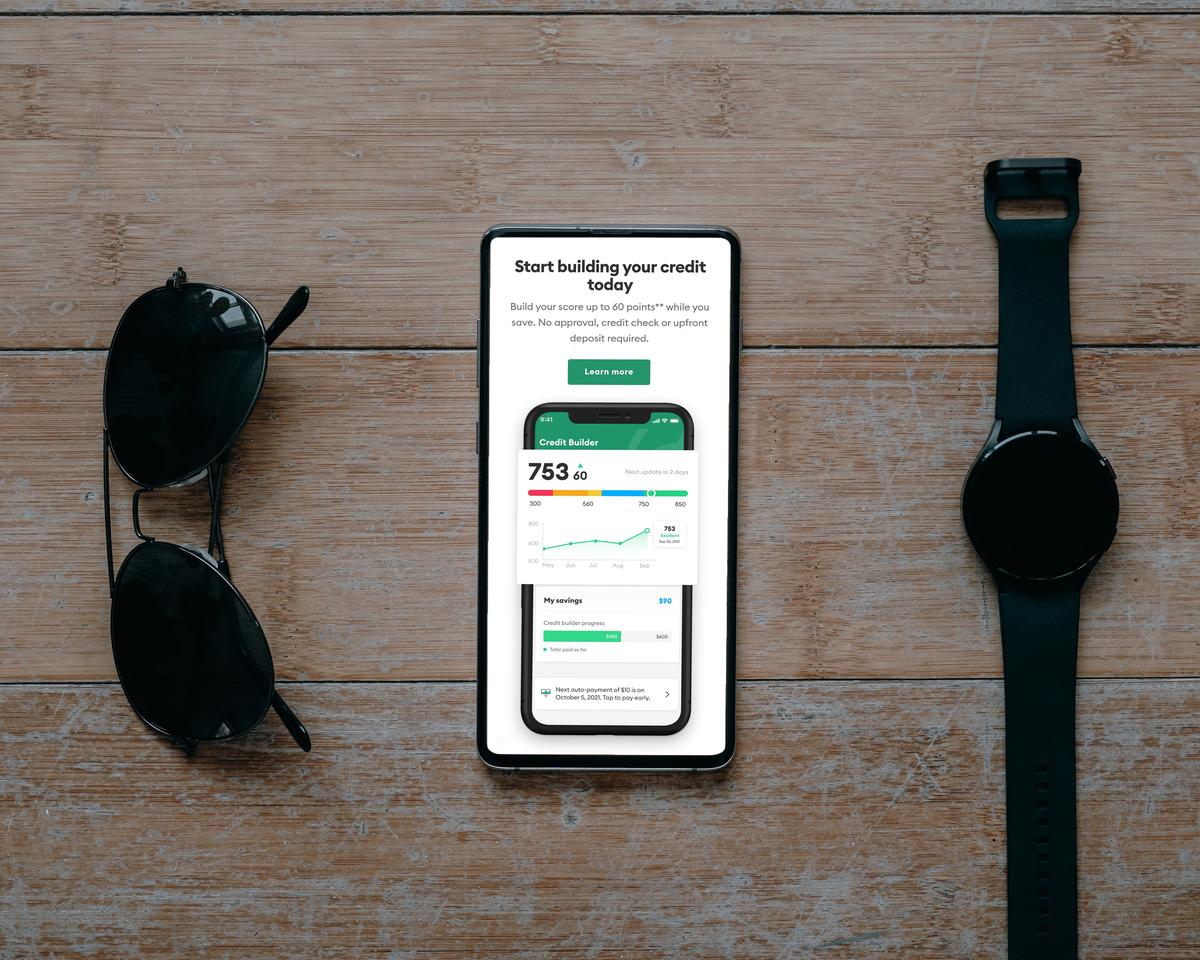

Photo by calum_mac on Unsplash

Range of Credit Scores

A credit score is typically a three-digit figure derived from a calculated interpretation of data in an individual’s credit file. It’s utilized by lenders to determine a potential borrower’s creditworthiness. The FICO and VantageScore models are the most frequently used for credit scores that range from 300 to 850.

Poor Credit Score

A poor credit score typically falls in the range of 300-579. Having a poor credit score makes it difficult to secure credit products such as loans and credit cards. If approved, consumers will likely face higher interest rates and more restrictive terms. Improving a poor credit score requires establishing a history of responsible credit behavior, which includes making timely payments and keeping balances low.

Fair Credit Score

Scores in the range of 580-669 are generally considered as fair. Consumers with fair credit may have experienced some credit missteps in the past, but they still have room to improve. While they can still obtain credit, they often face higher interest rates than those with good or excellent scores.

Good Credit Score

A good credit score ranges from 670-739. Leaning towards the higher side of the credit-score spectrum, individuals with good credit scores will usually find it easier to qualify for credit, and are offered more favorable terms, such as lower interest rates.

Very Good Credit Score

Credit scores in the range of 740-799 are considered very good. Consumers in this bracket are likely to be granted loans or credit cards with low interest rates. It indicates that you’ve managed your credit responsibly, and on time for a substantial period.

Excellent Credit Score

The highest tier of the credit-score spectrum is 800 and above, which is considered excellent. With an excellent score, consumers will enjoy the best interest rates and terms on loans and credit cards. It signals to lenders that consumers are exceptionally low risk.

Credit Score Vs. Credit Report

While a credit score is a numerical representation of your credit health, it’s important to regularly review your credit report as well. This report contains the data used to calculate your score, including debt levels, the number of open accounts, total available credit, and the integrity of payments made.

Having a high credit score doesn’t mean you need to have a flawless credit history. But habitual late payments or a high level of debt can negatively impact your credit score. To keep your score in good standing, ensure you regularly pay your credit card bills and loans on time, limit your debt, and only apply for credit as needed.

The key is making conscious decisions based on your knowledge of how your financial habits affect your credit health. It’s a process that takes time but offers considerable financial advantages. For in-depth guidance on managing your credit, check out the Consumer Financial Protection Bureau.

Photo by piggybank on Unsplash

What Does a Credit Score Represent?

A credit score is a numeric indication of a person’s creditworthiness, with the scale typically ranging from 300 to 850. Various credit bureaus, such as Experian, Equifax, and TransUnion, use distinct scoring models to calculate separate credit scores. However, the Fair Isaac Corporation’s FICO score is the most commonly utilized and accepted model.

What is a Good Credit Score?

Generally, a credit score above 700 is considered good. A score of 800 or more is classified as excellent. Here’s how the FICO scoring range is typically broken down:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Having a higher credit score is beneficial as it represents lower risk to lenders and creditors, potentially making it easier to get approved for loans with lower interest rates.

Boosting Your Credit Score

Understanding how to maintain or improve your credit score can be essential to your financial health. Below are some strategies to consider:

- Payment History: This is the most significant factor affecting credit scores. Always pay your bills on time, even if it’s just the minimum due.

- Credit Utilization: This refers to the amount of credit you’re currently using compared to your total available credit limits. Maintaining a credit utilization ratio of under 30% is advisable.

- Long Credit History: The length of your credit history can impact your scores. It can be beneficial to keep older credit accounts open as long as they’re not costing you unnecessary fees.

- Avoid New Credit: Don’t rush to open new credit accounts. Each account opened entails an inquiry into your credit, which can temporarily lower your score.

- Mix of Credit Types: A mix of credit products shows you can handle different types of credit. If possible, have both revolving credit (like credit cards) and installment loans (like a car or mortgage loan).

Keeping an Eye on Your Credit Score

With the utmost commitment to realism, it is essential to monitor your credit reports as it helps ensure the correctness of the information provided to the credit bureaus. As a general public member, you have the right to access a complimentary report from each bureau once a year via AnnualCreditReport.com.

A valuable asset in this process are credit monitoring services. These services regularly inform you of changes to your credit reports, provide alerts on possible fraudulent activities, or report alterations that could influence your scores. Certain services come with additional features which include access to your FICO scores.

It’s worth noting that enhancing or building your credit score needs time and discipline. Concentrating on reinforced financial habits will gradually elevate your credit score over a period of time.

Impact of Good Credit Score

The Ins and Outs of Credit Scores

A credit score is a quantified indicator ranging from 300 to 850 in the form of a three-digit number, used by lenders to evaluate an individual’s creditworthiness. This score, reflecting financial reliability, is calculated based on the information contained in your credit report. Remember, the higher the score, the greater the individual’s perceived financial credibility.

What is a Good Credit Score

In general, a credit score above 670 is considered to be ‘good’ based on the FICO scoring model. However, a score of 740 or above is deemed ‘very good’, and a score of 800 or more qualifies as ‘excellent’. Each lender might have its own standards for what it considers a good or bad credit score, but these ranges provide a general guideline.

Benefits of a Good Credit Score

Having a good credit score can make a tangible difference in your life. Besides being a deciding factor in whether or not you can get approved for a loan or a credit card, your credit score can also influence the interest rate offered to you. For example, the better your credit, the lower the interest rate you’re likely to be offered. Over time, lower interest rates can save you significant amounts of money.

A good credit score can also help improve your chances of getting approved for rental applications. Many landlords utilize credit scores to screen tenants, as a good credit score can indicate that you are financially responsible and are likely to pay your rent on time.

Some employers also check credit scores when considering potential candidates for certain positions, especially in the financial industry. A good credit score may demonstrate financial stability, which could make you a more attractive candidate.

Moreover, your credit score can affect your insurance premiums. In some states, insurers use credit-based insurance scores (which use information from credit reports) to help determine your premium. A better credit history might lead to lower premiums.

Potential Savings with a Good Credit Score

The savings that can be accrued over time with a good credit score can prove to be substantial. For instance, on a 30-year mortgage of $200,000, a borrower with a very good credit score (740-799) could save nearly $29,000 in interest compared to a borrower with a fair credit score (580-669), according to Experian.

Similarly, when it comes to car loans, a good credit score could help you save thousands of dollars over the course of the loan. Individuals with excellent credit scores can generally secure auto loan interest rates in the low single digits, while those with fair or poor scores may face interest rates as high as 10% to 20%.

With these benefits and potential savings in mind, it’s clear how critical maintaining a good credit score can be for your financial health.

Undoubtedly, a good credit score opens doors to better financial opportunities and empowers individuals to have more control over their financial health. Understanding its important role and the factors that influence it can contribute massively to better financial planning and decisions. Efforts put towards bolstering your credit score today can result in significant savings and financial benefits in the future. Moreover, maintaining a good credit score goes beyond just saving money; it can influence your job offers and rental applications. With the right knowledge and tools under your belt, you can take the reins of your financial journey, ensuring a prosperous and stable future.